This page provides a summary of the Registered tax practitioner symbol guidelines. The complete guidelines containing all images and diagrams are available as a PDF – Registered tax practitioner symbol guidelines (PDF, 4.9MB). The complete guidelines will take precedence in case of any inconsistency with this summary.

Overview

The Tax Practitioners Board (TPB) has developed a Registered tax practitioner symbol (symbol) for use by registered tax agents, BAS agents and tax (financial) advisers (collectively known as 'tax practitioners') who have agreed to the Terms and conditions of use. The symbol is designed to provide registered tax practitioners with public recognition that they are registered, have met the eligibility requirements and are obliged to meet appropriate standards of professional and ethical conduct in providing tax agent, BAS or tax (financial) advice services to clients.

All registered tax practitioners who meet the eligibility criteria are permitted to use the symbol under a licence granted to the tax practitioner by the TPB. These tax practitioners may use the symbol in advertising, thereby promoting confidence among consumers.

Registered tax practitioners must use the symbol in conjunction with their registration number.

The symbol is registered as a certified trade mark, providing authenticity to it and ensuring that the TPB has registered rights in it.

Registered tax practitioners who use the symbol are required to comply with the Terms and conditions of use and the Certified trade mark rules. We recommend that these are read in conjunction with these guidelines.

These guidelines explain and demonstrate the ways you, as a registered tax practitioner, may use the symbol, once you have agreed to the Terms and conditions of use. The guidelines, the Terms and conditions of use, and the Certified trade mark rules ensure consistent and professional use of the symbol to build and maintain its integrity.

Who can use the symbol – eligibility criteria

Registered tax practitioners who meet the following eligibility criteria are permitted to use the registered tax practitioner symbol under a licence we grant:

-

you are registered with the TPB as a tax agent or a BAS agent or a tax (financial) adviser (including partnership and company tax practitioners). This excludes entities that are currently registered, or taken to be registered, as a tax (financial) adviser by virtue of items 49 and 50 of the Tax Laws Amendment (2013 Measures No.3) Act 2013

-

you have agreed to the symbol’s Terms and conditions of use, and abide by them, including the requirement to follow the Certified trade mark rules relating to the symbol

-

you are not a registered practitioner whose licence to use the symbol has been cancelled by the TPB.

The licence to use the symbol is granted at the absolute discretion of the TPB and may be cancelled by us where, for example, a tax practitioner does not comply with the Terms and conditions of use. For further details, refer to Terms and conditions of use.

Visual requirements

Components

The Registered symbol includes three elements:

-

the logo/graphic

-

the type of tax practitioner – that is, tax or BAS agent or tax (financial) adviser

-

the registration number of the tax practitioner.

Note: The size and spacing relationship of components are fixed, and must not be altered.

Minimum size

The Registered symbol must meet minimum size requirements:

-

Stacked version - 22mm wide (136 pixels) for electronic media and 18mm wide for print media

-

Inline version - 44.5mm wide (168 pixels).

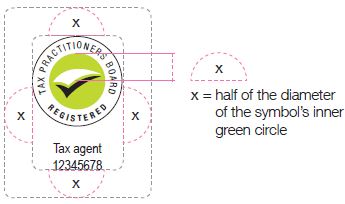

Minimum clear space or exclusion zones

The minimum 'clear space' surrounding the Registered symbol is defined by the area 'x' (half the diameter of the symbol’s inner green circle), shown below in the tax agent example. This exclusion zone ensures the symbol has adequate visibility and prominence on all communications. You can see examples on page 4 of the PDF version of these guidelines.

The symbol must never be placed over photographic, patterned or complicated backgrounds.

The symbol should be placed on a white background wherever possible. If the background cannot be white, it must be uncluttered and provide enough contrast to ensure adequate legibility.

Accessing the symbol

To access the Registered tax practitioner symbol, refer to How to download the symbol

Co-branding

As a registered tax practitioner you are permitted to co-brand your stationery and marketing materials with the Registered tax practitioner symbol. You can see examples on pages 8–16 of the PDF version of these guidelines.

Alignment

Our preference is for the Registered tax practitioner symbol to be positioned to the right of your practice logo with the bottom edges aligned. You can see an example on page 4 of the PDF version of these guidelines.

We recommend placing the symbol in the bottom right corner, ensuring you apply the minimum exclusion zones mentioned above.

Usage

Authorised use of the symbol

The Registered tax practitioner symbol must only be used:

-

by registered tax practitioners who have agreed to and abide by the Terms and conditions of use for the symbol, including a requirement to comply with the Registered tax practitioner symbol guidelines

-

by a registered tax practitioner whose licence to use the symbol has not been cancelled by the TPB

-

if it is accompanied by the tax practitioner's registration number

-

in accordance with any directions we may publish from time to time on our website.

Where a registered tax practitioner partnership contracts with another entity to provide a tax agent or BAS service or tax (financial) advice, they must use the partnership’s registration number in conjunction with the symbol, not the registration number of any registered tax practitioner partner associated with the partnership.

Where a registered tax practitioner company contracts with another entity to provide a tax agent or BAS service or tax (financial) advice, they must use the company’s registration number in conjunction with the symbol, not the registration number of any other registered tax practitioner associated with the company.

Restrictions using the symbol

The Registered tax practitioner symbol must not be used inappropriately. Some examples of inappropriate use are using it:

-

in a manner that breaches the Terms and conditions of use, including a requirement to comply with the Registered tax practitioner symbol guidelines

-

in a manner that breaches any directions from us about its use

-

without a tax practitioner's registration number

-

without any connection to the provision of tax agent or BAS or tax (financial) advice services by, or on behalf of, a registered tax practitioner

-

without the name of the registered tax practitioner on written materials

-

in a misleading or deceptive manner, or in any way that is illegal

-

in a manner that infringes our intellectual property and other rights in the symbol –for example, our registered rights in relation to the symbol as a certified trade mark

-

in a way that is likely to damage the reputation of the symbol or the TPB

-

in a manner that makes improper or undesirable associations with the symbol – for example, it must not be displayed on inappropriate websites, for example gambling or adult entertainment websites.

If a tax practitioner sells their business, or relocates their business premises for any reason, the tax practitioner must not permit the symbol to remain on signs, awnings or other visual displays at their former business premises. They must remove the symbol from any signs, awnings or other visual displays, at their own expense when they leave the premises, or if directed to do so by us.

When the symbol must not be used

The Registered tax practitioner symbol must not be used where an entity:

-

is not registered with the TPB

-

does not apply to renew their tax or BAS agent or tax (financial) adviser registration within the required timeframe in the Tax Agent Services Act 2009 (TASA)

-

has had their application for renewal of registration rejected

-

surrenders their registration

-

has died

-

goes into external administration or is wound up (where the entity is a company)

-

is suspended or terminated as a registered tax practitioner

-

has been directed by us to not use the symbol.

Incorrect use

The following are examples of incorrect use of the Registered tax practitioner symbol:

-

attempting to redesign or amend the symbol

-

rotating the symbol or placing it on an angle

-

applying effects to the symbol – for example, key lines, drop shadows, glows or outlines

-

altering the colour of the symbol

-

placing the symbol on a patterned, photographic or complicated background

-

allowing other elements within the exclusion zone or obscuring the symbol in any way

-

distorting the symbol to fit a space or application

-

supplying the symbol to any external service provider or other entity without permission from us (unless it is to an entity who is engaged in facilitating your use of the symbol)

-

using the symbol below the minimum size requirements

-

re-positioning the registration number

-

using the symbol without the registration number

-

using coloured text for the registration number

-

inserting the registration number at a font size smaller than seven point

-

cobranding the symbol with the TPB or other logos.

You can see examples of incorrect use on page 18 of the PDF version of these guidelines.

File formats and colour models

Types of files we supply

We supply the Registered tax practitioner symbol in file types to suit general office users, professional designers and publishers.

You can download the symbol in SVG, JPG and PNG file formats. All are compatible with both PC and Macintosh platforms.

We offer colour and black (mono) and white (mono reversed) versions of the symbol. The colour version should be used wherever possible. When colour is not available, the mono or mono reversed version may be used. However, a level of contrast must be maintained for maximum legibility. You can see examples on page 6 of the PDF version of these guidelines.

Note: You should only ever use an original, unaltered file downloaded from our website. Do not attempt to redesign or amend the symbol.

File format definitions

Vector graphics (SVG)

For printed material, print advertisements, brochures and billboards, where high resolution and large logo size are crucial. SVG files are scalable without losing quality or fidelity. They are typically of smaller file size, and can be easily repurposed in multiple locations on a site. SVG files can be opened with Adobe Illustrator, Photoshop, InDesign, Visio or any modern web browser such as Chrome, Firefox, Edge or Internet Explorer.

Raster graphics (JPG and PNG)

A raster image is a photograph or picture made up of pixels. Raster files are suitable for emailing, placing in Word documents and for web use.

JPG – Usually suitable for many applications including printed materials, provided there is an appropriate resolution for the purpose. It can also be used for lower resolution internet and web graphics and on computer presentations in the RGB format. See Colour models description on page 6 of the PDF version of these guidelines.

PNG – Perfect for internet and web graphics, or for use in presentations for display on a computer screen. PNG images have the option of assigning a transparent background, which allows the image to float over other graphic backgrounds. PNG format is not suitable for print use.

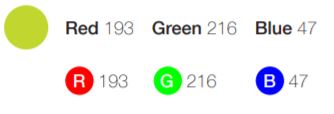

Colour models description

CMYK (Cyan, Magenta, Yellow and Black)

These are the colours of the traditional four colour print process (full-colour). RGB images have to be converted to CMYK in the pre-press process in order to run on an appropriate printer.

RGB (Red, Green and Blue)

These are the colours used to produce images on computer screens. Sources of RGB images are digital cameras, scanners, video capture and web pages. RGB images are not appropriate for print use; they are only for web use.

Examples

For examples of recommended uses of the symbol with your practice stationery, website and window signage refer to pages 8 – 16 of the PDF version of these guidelines.

Further information

For more information refer to:

Last modified: 9 August 2019