Disclaimer

This is a Tax Practitioners Board (TPB) Information sheet (TPB(I)). It is intended to be for information only. It provides information regarding the TPB’s position on the application of subsection 90-15 of the Tax Agent Services Act 2009 (TASA), containing the definition of a tax (financial) advice service.

While it seeks to provide practical assistance and explanation, it does not exhaust, prescribe or limit the scope of the TPB’s powers in the TASA. In addition, please note that the principles, explanations and examples in this TPB(I) do not constitute legal advice and do not create additional rights or legal obligations beyond those that are contained in the TASA or which may exist at law. Please refer to the TASA for the precise content of the legislative requirements.

Document history

Following earlier consultations, the TPB released this document in the form of an exposure draft on 7 March 2014. The TPB invited comments and submissions in relation to the information contained in it. The closing date for submissions was 6 April 2014. The TPB considered the submissions made and published the following TPB(I) on 30 June 2014.

On 1 April 2022, the TPB updated this TPB(I) to replace references from the repealed Tax Agent Services Regulations 2009 to Tax Agent Services Regulations 2022.

Issued: 30 June 2014

Last modified: 1 April 2022

Introduction

- From 1 January 2022, entities that provide tax (financial) advice services for a fee or other reward must be either a qualified tax relevant provider (QTRP) with the Australian Securities and Investments Commission (ASIC) or a tax agent registered with the Tax Practitioners Board (TPB).[1]

- The entities that are not eligible to be a QTRP with ASIC must register as a tax agent with the TPB[2] to provide tax (financial) advice services legally.

- This TPB Information Sheet (TPB(I)) has been prepared by the TPB to assist entities to determine if they are providing a tax (financial) advice service and whether they need to register with the TPB.

- Whether a particular service is a tax (financial) advice service is a question of fact. This means that each service will need to be considered on a case-by-case basis having regard to the facts and circumstances surrounding the provision of the service.

Tax (financial) advice service

Legislative background

- Tax (financial) advice service’ is defined in section 90-15 of the Tax Agent Services Act 2009 (TASA) as follows:

- A tax (financial) advice service is a *tax agent service (other than within the meaning of subparagraph (1)(a)(iii) of the definition of that expression) provided by a *financial services licensee or a *representative of a financial services licensee in the course of giving advice of a kind usually given by a financial services licensee or a representative of a financial services licensee to the extent that:

- the service relates to:

- ascertaining liabilities, obligations or entitlements of an entity that arise, or could arise, under a *taxation law; or

- advising an entity about liabilities, obligations or entitlements of the entity or another entity that arise, or could arise, under a taxation law; and

- the service is provided in circumstances where the entity can reasonably be expected to rely on the service for either or both of the following purposes:

- to satisfy liabilities or obligations that arise, or could arise, under a taxation law;

- to claim entitlements that arise, or could arise, under a taxation law.

- the service relates to:

- The Board may, by legislative instrument, specify that another service is a tax (financial) advice service.

- However, a service is not a tax (financial) advice service if:

- it consists of preparing a return or a statement in the nature of a return; or

- it is specified in the regulations for the purposes of this paragraph[3].

- A tax (financial) advice service is a *tax agent service (other than within the meaning of subparagraph (1)(a)(iii) of the definition of that expression) provided by a *financial services licensee or a *representative of a financial services licensee in the course of giving advice of a kind usually given by a financial services licensee or a representative of a financial services licensee to the extent that:

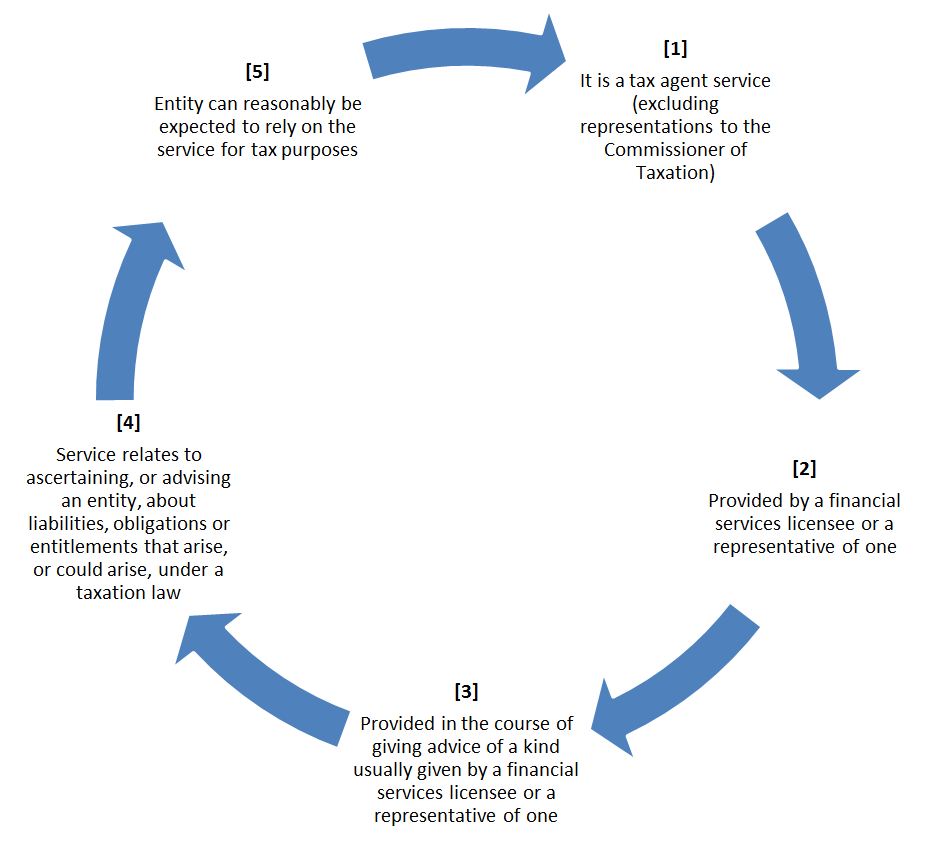

- The following diagram summarises all the five key elements of a tax (financial) advice service:

Element 1 – tax agent service (excluding representations to the Commissioner)

- To be a tax (financial) advice service, the service must be a tax agent service[4], but it excludes representing a client to the Commissioner of Taxation (Commissioner).

- For example, tax advice provided in circumstances where an entity (or client) can reasonably expect to rely on it to satisfy liabilities or claim entitlements under the taxation laws[5] is a tax agent service that will generally also be a tax (financial) advice service.

- In contrast, ‘general advice’ as defined in section 766B of the Corporations Act 2001 will not be a tax agent service (and therefore also not a tax (financial) advice service) as it does not take into consideration a client’s specific circumstances and hence it is not reasonable to expect an entity to rely on it.

Element 2 – provided by a financial services licensee or a representative

- To be a tax (financial) advice service, a service must be provided by a financial services licensee or a representative of a financial services licensee.

- Under the Corporations Act 2001, an entity (or provider) that carries on a financial services business in Australia needs to hold an ‘Australian financial services licence’ (AFS licence), unless an exemption applies. For example, an entity does not need to hold a licence to provide financial services as a representative of a financial services licensee.

- A representative (of a financial services licensee) is defined in paragraph 910A(a) of the Corporations Act 2001 and includes an authorised representative. An authorised representative is defined in section 761A of the Corporations Act 2001 to be a person authorised to provide financial services on behalf of a financial services licensee.

Element 3 – provided in the course of advice usually given by a licensee or representative

- The relevant service must be provided in the course of giving advice of a kind usually given by a financial services licensee or a representative of a financial services licensee.

- Entities in the financial services industry usually provide their clients with a range of advice and strategies for managing their financial affairs including in relation to wealth management, retirement planning, estate planning and risk management.

- Specifically, an AFS licence authorises licensees to, among other things, provide financial product advice to clients.

- Financial product advice is defined in section 766B of the Corporations Act 2001 to mean a recommendation or a statement of opinion, or a report of either of those things that:

- is intended to influence a person or persons in making a decision in relation to a particular financial product or class of financial products, or an interest in a particular financial product or class of financial products; or

- could reasonably be regarded as being intended to have such an influence.

Subsection 766B(2) of the Corporations Act 2001 provides that there are two forms of financial product advice, personal advice and general advice. These two forms of advice are also defined in section 766B of the Corporations Act 2001 and can be described as follows:

Personal advice

General advice

- Financial product advice given or directed to a person (including by electronic means) in circumstances where:

- the person giving the advice has considered one or more of the client’s objectives, financial situation and needs; or

- a reasonable person might expect the person giving the advice to have considered one or more of these matters.

- All other financial product advice.

- Financial product advice given or directed to a person (including by electronic means) in circumstances where:

- For the purposes of being a tax (financial) advice service, it does not matter whether the advice is financial product advice or dealing in a financial product as defined in the Corporations Act 2001. The relevant test is whether the tax agent service is given in the course of advice that is usually given by a financial services licensee or a representative. This means that the service will usually take the form of tax advice that can reasonably be expected to be relied on for tax purposes that is given for the purpose of helping to fully inform a client about their current and future financial affairs. As such, it could be given:

- as part of a strategic discussion about a client’s long-term financial objectives;

- in the course of advising a client about the relative merits of particular financial products or other investments; or

- in the course of advising a client about non-financial products such as real property or collectables.

Element 4 – relates to ascertaining or advising about obligations under a taxation law

- To be a tax (financial) advice service, the service must relate to:

- ascertaining liabilities, obligations or entitlements of an entity that arise, or could arise, under a taxation law; or

- advising an entity about liabilities, obligations or entitlements of the entity or another entity that arise, or could arise, under a taxation law.

- Taxation laws include any Act of which the Commissioner has general administration of, or any regulations made under such an Act. Key Acts include, but are not limited to, the:

- Income Tax Assessment Act 1936;

- Income Tax Assessment Act 1997;

- Superannuation Industry (Supervision) Act 1993; and

- Fringe Benefits Tax Assessment Act 1986.

- Taxation laws also include the TASA and regulations made under the TASA, for which the TPB has general administration.

Element 5 – reliance for tax purposes

- A service will be a tax (financial) advice service only if it is provided in circumstances where the entity (or client) can reasonably be expected to rely on the service for either or both of the following purposes:

- to satisfy liabilities or obligations that arise, or could arise, under a taxation law

- to claim entitlements that arise, or could arise, under a taxation law.

- To determine circumstances in which a client can reasonably be expected to rely on a service being provided, it is necessary to consider the facts and circumstances surrounding the provision of the service.[6] Some of the key facts and circumstances to consider, as taken from relevant legislative guidance and case law, include:

- whether the provider of the service has to interpret or apply a taxation law and therefore requires a certain level of knowledge about a taxation law

- whether the provider of the service applies knowledge of the taxation laws to a client’s individual circumstances

- whether the client, or another entity, checks or reviews the work before purporting to rely on it

- whether the provider of the service intended the client to rely on the advice or information provided

- whether the client has a relative lack of knowledge or prior experience in relation to the service, perhaps indicating that the client regards the skill and experience of the entity providing the service as superior to their own

- the availability of other expert/s and the ability of a client to form their own judgment or rely on their own knowledge

- the circumstances surrounding the provision of the service, including the nature of the relationship/dealings between the parties (for example, whether the service is provided as part of a formal consultation or merely during the course of a casual conversation/engagement). Further circumstances that may be relevant include whether the client has specifically requested the service or has paid for the service

- the level of complexity surrounding the particular service

- whether the provider of the service suggested or encouraged the client to seek further advice in relation to the matter

- the nature of the advice or information given - for example, it will unlikely be reasonable to expect a client to rely on a provisional opinion in speculative circumstances or an “off-the-cuff” statement where the service provider gave no indication that they possessed greater knowledge or skill in relation to the matter

- whether the provider of the service has provided an effective disclaimer against responsibility for the service. However, the existence of a disclaimer does not automatically absolve the entity providing the service from registration and the effect of such a disclaimer will generally depend on all the circumstances of the case, including the relative knowledge and skill of the provider and the complexity and/or significance of the service provided.[7]

Summary

- Whether personal advice or advice about Tier 1 or Tier 2 products falls within the definition of tax (financial) advice service for the purposes of the TASA will depend on the application of the five elements identified in this TPB Information Sheet. If these five elements are satisfied, then it is a tax (financial) advice service.

- A list of indicative tax (financial) advice services can be found in Appendix A – Examples of tax (financial) advice services.

Key terms

| Financial services licensee | Financial services licensee has the same meaning as in Chapter 7 of the Corporations Act 2001. |

|---|---|

| Representative | Representative has the meaning given by paragraph (a) of the definition of that expression in section 910A of the Corporations Act 2001 |

| Tax agent service | Tax agent service is defined in section 90-5 of the TASA as any service:

Note: subsection 90-5(2) of the TASA provides that a service specified in the Tax Agent Services Regulations 2022 for the purposes of this subsection is not a tax agent service. |

| Taxation law | Taxation law is defined in section 995-1 of the Income Tax Assessment Act 1997 to mean an Act (including a part of an Act) of which the Commissioner has the general administration, or regulations under such an Act. Taxation law also includes the TASA and regulations made under the TASA, for which the TPB has general administration. |

Appendix A - Examples of tax (financial) advice services

The following table contains a non-exhaustive list of the types of services commonly provided and whether they constitute a tax (financial) advice service.

| Service | Tax (financial) advice service | Tax agent service | |

|---|---|---|---|

| 1 | Any service specified by the TPB by legislative instrument to be a tax (financial) advice service. | Yes | Yes |

| 2 | Personal advice (as defined in the Corporations Act 2001), including scaled advice and intra-fund advice, which involves the application or interpretation of the taxation laws to a client’s personal circumstances and it is reasonable for the client to expect to rely on the advice for tax purposes. |

Yes |

Yes |

| 3 | Any advice (other than a financial product advice as defined in the Corporations Act 2001) that is provided in the course of giving advice of a kind usually given by a financial services licensee or a representative of a financial services licensee that involves application or interpretation of the taxation laws to the client’s personal circumstances, and it is reasonable for the client to expect to rely on the advice for tax purposes. |

Yes |

Yes |

| 4 | Factual tax information which does not involve the application or interpretation of the taxation laws to the client’s personal circumstances. Such information could be included in, but is not limited to:

|

No |

No |

| 5 | Client tax-related factual information. Such information includes, but is not limited to:

|

No |

No |

| 6 | General advice (as defined in the Corporations Act 2001). | No | No |

| 7 | Any service that does not take into account an entity’s relevant circumstances so that it is not reasonable for the entity to expect to rely on it for tax purposes. This includes simple online calculators as defined in the Australian Securities and Investments Commission’s Class Order (CO 05/1122). | No | No |

| 8 | Factual information provided by call centres and front line staff and specialists that would not be expected to be relied upon for tax related purposes. | No | No |

| 9 | Preparing a return or a statement in the nature of a return (to provide this service would require registration as a tax agent). | No | Yes |

| 10 | Preparing an objection under Part IVC of the Taxation Administration Act 1953 against an assessment, determination, notice or decision under a taxation law. | No | Yes |

| 11 | A service specified not to be a tax agent service in Section 26 of the Tax Agent Services Regulations 2022. | No | No |

| 12 | Dealing with the Commissioner of Taxation on behalf of a client. This may include, for example, applying for a private binding ruling on behalf of a client. | No | Yes |

Resources

[1] A single disciplinary body (SDB) to regulate financial advisers was established on 1 January 2022 to implement Recommendation 2.10 of the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services. The SDB requires all financial advisers who provide personal financial advice to retail clients to be registered. Those entities that do not qualify to be registered with the SDB must be registered with the TPB to provide tax (financial) advice services legally. For further information see Financial Sector Reform (Hayne Royal Commission Response—Better Advice) Act 2021.

[2] The Better Advice Act 2021 provides a transitional arrangement which allows those that were registered as tax (financial) advisers with the TPB as at 31 December 2021, or lodged an application to register as a tax (financial) adviser with the TPB by 31 December 2021 and were registered after this date, to legally provide tax (financial) advice services until 31 December 2022 without a tax agent registration. From 1 January 2023 these entities must be registered as a tax agent with the TPB to provide tax (financial) advice services legally.

[3] The use of an asterisk ‘*’ indicates that the term is a defined term in the TASA. For further information, see the ‘key terms’ section of this TPB(I).

[4] ‘Tax agent service’ is defined in section 90-5 of the TASA. See also the ‘key terms’ section of this TPB(I).

[5] For more information regarding the meaning of ‘taxation laws’, see paragraph 19 of this TPB(I).

[6] For more information on whether a client can expect to rely on a service for tax purposes, see paragraphs 1.14 and 1.15 of the Explanatory Memorandum to the Tax Laws Amendment (2013 Measures No. 3) Bill 2013.

[7] Use of the word ‘disclaimer’ in this paragraph means a general disclaimer.