Disclaimer

This is a Tax Practitioners Board (TPB) Information sheet (TPB(I)). It is intended to be for information only. It provides an overview of the TPB’s position in relation to the circumstances in which an individual will be required to demonstrate knowledge of the Tax Agent Services Act 2009 (TASA), including the Code of Professional Conduct (Code), for the purposes of registration as a tax agent or BAS agent. While it seeks to provide practical assistance and explanation, it does not exhaust, prescribe or limit the scope of the TPB’s powers provided in the TASA.

In addition, please note that the principles, explanation and examples in this TPB(I) do not constitute legal advice and do not create additional rights or legal obligations beyond those that are contained in the TASA, the Tax Agent Services Regulations 2022 (TASR), or which may exist at law. Please refer to the TASA and TASR for the precise content of the legislative requirements.

Document history

The TPB released this document as a draft Information sheet in the form of an Exposure draft on 9 September 2011. The TPB invited comments and submissions in relation to the information in it. The closing date for submissions was 24 October 2011. The TPB considered the submissions made and published this TPB(I) on 15 December 2011, subject to the following amendments:

- On 8 December 2014 the TPB amended the TPB(I) to incorporate the knowledge requirements of the TASA, including the Code, for tax (financial) advisers.

- On 1 April 2022 the TPB updated this TPB(I) to remove references to tax (financial) advisers and replace references from the repealed Tax Agent Services Regulations 2009 to Tax Agent Services Regulations 2022.

- On 1 July 2022 the TPB updated this TPB(I) to replace its continuing professional education (CPE) policy link included in this TPB(I) with that of the new CPE policy taking effect on 1 July 2022.

- On 10 January 2024, the TPB updated this TPB(I) to reflect changes made to the objects clause in the TASA

Issued: 15 December 2011

Last modified: 10 January 2024

Introduction

- This Tax Practitioners Board Information Sheet (TPB(I)) sets out the views of the Tax Practitioners Board (TPB) in relation to the circumstances in which an individual will be required to demonstrate knowledge of the Tax Agent Services Act 2009 (TASA), including the Code of Professional Conduct (Code), for the purposes of registration as a tax agent or BAS agent. Further, this TPB(I) sets out the content requirements of the TPB in relation to being able to demonstrate such knowledge.

- The information in this TPB(I) is particularly relevant for those individuals who are required to have completed Board approved courses in Australian taxation law (for tax agents) and basic GST/BAS taxation principles (for BAS agents). [1]

- The information contained in this TPB(I) is intended to assist individuals in understanding the TPB’s requirements in relation to required knowledge of the TASA, including the Code, and also to assist approved course providers in developing courses that meet the TPB’s requirements.

Structure and summary of this TPB(I)

- In this TPB(I) you will find the following information

- background and scope about the tax agent services regime (paragraphs 5 to 9)

- who is required to demonstrate knowledge of the TASA, including the Code as it relates to:

- tax and BAS agents registered as at 1 July 2013 (paragraphs 11 to 13)

- all other applicants from 1 July 2013 (paragraphs 14 to 16)

- the requirements of a unit in the TASA, including the Code (paragraphs 17 to 33).

Background and scope

- The legislative regime governing the provision of tax agent services, (which includes BAS services and tax (financial) advice services) is contained in the TASA.

- The object of the TASA is to support public trust and confidence in the integrity of the tax profession and the tax system by ensuring that tax agent services are provided to the community in accordance with appropriate standards of professional and ethical conduct.[2] This is to be achieved by, among other things, providing for:

- the registration and regulation of entities that provide tax agent services by a national Tax Practitioners Board

- a Code of Professional Conduct for registered tax practitioners [3]

- sanctions to discipline entities in relation to their conduct as a registered tax practitioner and for other non-compliance with the TASA.

- Entities providing a tax agent service for a fee or other reward are generally required to be registered under the TASA.

- To be eligible for registration, an entity must satisfy the TPB that it has met the registration requirements, which broadly consist of the following two elements:

- a fit and proper person requirement

- prescribed qualifications and experience requirements (for individuals), or the requirement to have a sufficient number of individuals who are registered (for companies and partnerships).

- Against this background, the TPB considers that an essential part of the qualifications requirement for registration as a tax agent or BAS agent is that individuals will need to be able to demonstrate their knowledge of the TASA, including the Code. Moreover, the TPB considers that knowledge of the TASA, including the Code, is an essential requirement for registered tax practitioners to be able to meet their statutory obligations in relation to the provision of tax agent services.

Who is required to demonstrate knowledge of the TASA including the Code?

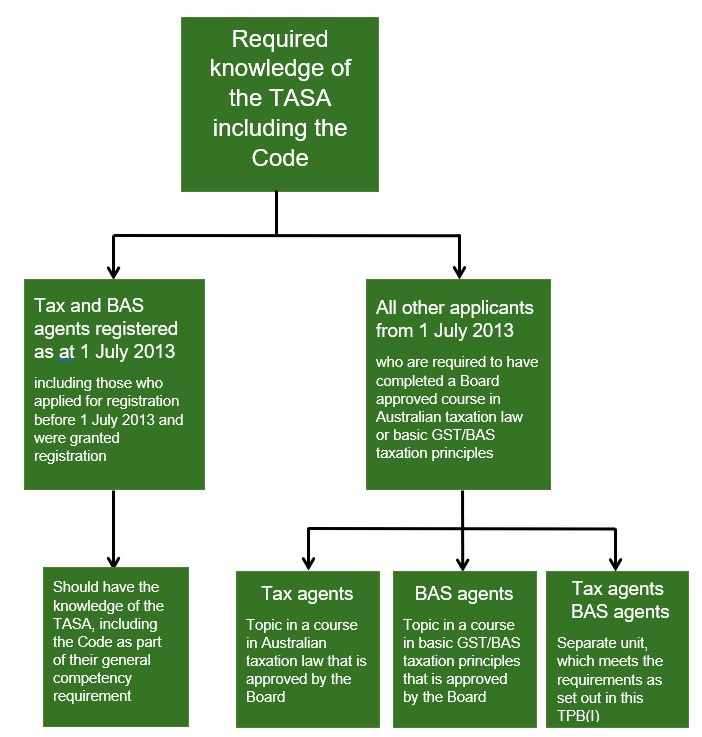

- The TPB’s approach regarding the circumstances in which an individual will be required to demonstrate knowledge of the TASA, including the Code, for the purposes of registration as a tax agent or BAS agent is summarised in the following diagram:

Tax and BAS agents registered as at 1 July 2013

- The TPB is of the view that individuals registered as a tax agent or BAS agent as at 1 July 2013, including those who applied for registration before 1 July 2013 and were granted registration, are expected to comply with the TASA, including the Code, and therefore should have knowledge of the TASA, including the Code, as part of their general competency requirement.

- The TPB expects that this knowledge will be able to be enhanced through continuing professional education (CPE).[4]

- The TASA, including the Code, is one of the topic requirements for Board approved courses in Australian taxation law and basic GST/BAS taxation principles.[5]

All other applicants from 1 July 2013

- From 1 July 2013 all applicants who are required to have completed a course in Australian taxation law that is approved by the Board, or a course in basic GST/BAS taxation principles that is approved by the Board, must have completed a course, which includes a component in the TASA, including the Code. Where the course does not include a component in the TASA, including the Code, the applicant will be required to have completed a separate unit, which contains this component.

- Paragraphs 17 to 33 of this TPB(I) sets out the TPB’s views in relation to the requirements of a separate unit in the TASA, including the Code.

- The TPB's policy as contained in this TPB(I) does not prejudice the TPB's powers generally, including, but not limited to, the power under section 30-20 of the TASA to make an order requiring a registered tax practitioner to complete a course of education or training specified in the order.

Unit requirements

Approved course providers

- The approach of the TPB is to rely on the existing regulatory and quality assurance frameworks applicable to universities, registered training organisations, other registered higher education institutions and other course providers approved by the TPB in determining approved course providers for the purpose of providing Board approved courses.[6] Consistent with this approach, the TPB will rely on approved course providers to develop units that comply with the requirements of a unit in the TASA including the Code as set out in this TPB(I).

Topics

- A unit in the TASA, including the Code, should include the following topics:

- The objects of the TASA

- Registration process and eligibility requirements under the TASA, including knowledge of:

- the fit and proper person requirement [7]

- prescribed qualifications and experience requirements (for individuals), or the requirement to have a sufficient number of individuals who are registered to provide tax agent services to a competent standard and to carry out supervisory arrangements (for companies and partnerships)

- The Code of Professional Conduct[8] including the underlying content of the professional and ethical standards required of registered tax practitioners that are contained in the Code in section 30-10 of the TASA.

- Administrative sanctions that may be imposed for a breach of the Code, including:

- written cautions from the Board

- orders from the Board requiring specified action to be taken (including requiring a registered tax practitioner to complete a course of training or requiring a registered tax practitioner to practise under supervision)

- suspension of registration

- termination of registration.

- Civil penalty provisions, including:

- contraventions that apply to the conduct of entities that are not registered:

- providing tax agent services without being registered

- advertising tax agent services without being registered

- representing that you are a registered tax practitioner without being registered

- contraventions applicable to the conduct of registered tax practitioners:

- making false or misleading statements

- using deregistered entities

- improperly signing a declaration or other statement

- contraventions that apply to the conduct of entities that are not registered:

- Board’s power to apply to the Federal Court for an injunction

- obligations to notify the TPB of a change of circumstances.[9]

- Approved course providers must ensure that units in the TASA, including the Code, are regularly updated to take into account changes over time.

Unit level and learning outcomes

- The TPB’s view is that an individual should have an appropriate level of knowledge of the topics listed at paragraph 18.

- The appropriate level of knowledge for a registered BAS agent should be at a Certificate IV level, which is equivalent to a Level 4 as specified in the Australian Qualifications Framework (AQF).[10] This means that individuals will have theoretical and practical knowledge and skills for specialised and/or skilled work and/or further learning.

- For a registered tax agent, the appropriate level of knowledge should be at a Diploma level, which is equivalent to a Level 5 as specified in the AQF. This means that individuals will have specialised knowledge and skills for skilled/paraprofessional work and/or further learning.

- Within this framework, the TPB considers that the criteria specified by the AQF in relation to the knowledge, skills and application of that knowledge and skills in relation to Level 4 (for BAS agents) and Level 5 (for tax agents) represents appropriate learning outcomes for the topics listed at paragraph 18.

Structure of unit, mode of delivery and relationship to CPE

- The topics specified in paragraph 18 should either form the basis of a standalone unit in the TASA, including the Code, or could be embedded in another course – for example, as part of a course in Australian taxation law that is approved by the Board or as part of a course in basic GST/BAS taxation principles that is approved by the Board.

- The TPB is of the view that a hard-and-fast rule on the manner of delivery of a unit is not necessary. Provided that whatever manner is adopted in the unit involves an expectation that students will develop knowledge of the topics listed at paragraph 15 at the requisite level (see paragraphs 17 to 15), it is immaterial whether they are undertaking the unit in a face-to-face setting or via an online computer-based learning module or webinar, with an assessment at the end. The outcomes of the unit should be discernible by reference to how the unit is assessed.

- Registered tax practitioners should ensure their knowledge of the TASA, including the Code, remains current. A registered tax practitioner should maintain the currency of their knowledge of the TASA, including the Code, by undertaking relevant continuing professional education (CPE). The TPB considers that the completion of a unit, course or other study, which has been used for the purpose of gaining registration as a tax agent or BAS agent generally will not constitute a CPE activity.[11]

Duration

- A standalone unit in the TASA, including the Code, which covers the topics listed at paragraph 18 at the requisite depth and with an appropriate assessment, should be three hours, or half a day, in duration.

- Similar requirements as to duration would apply to a unit in the TASA, including the Code, which is embedded in another course – for example, a course in Australian taxation law or a course in basic GST/BAS taxation principles that is approved by the Board.

Assessment

- The TPB expects that knowledge of the unit requirements of the TASA, including the Code, is evidenced by appropriate assessment.

- An appropriate assessment for a BAS agent should be at the Certificate IV level, which is equivalent to a Level 4 as specified in the AQF.

- An appropriate assessment for a tax agent should be at the Diploma level, which is equivalent to a Level 5 as specified in the AQF.

- The TPB accepts that certification style exams are generally on a pass/fail basis and the TPB’s view is that such an assessment framework may be appropriate for this unit. At the same time the TPB accepts that graduated results (pass, credit, distinction) may also be appropriate.

- Assessments may occur by a variety of modes, including being conducted online, provided that suitable quality assurance mechanisms are in place to ensure the integrity of the examination process. For example, it is expected that a unit could be run as an online, computer-based module or webinar that applicants could undertake and then complete a form of assessment at the end of the module or webinar.

References

[1]See paragraph 10 of this TPB(I) for more information on who is required to demonstrate knowledge of the TASA, including the Code.

[2] Section 2-5 of the TASA

[3]‘Registered tax practitioners’ means registered tax agents and BAS agents.

[4] For further information regarding the TPB’s CPE policy for registered tax agents and BAS agents, refer to TPB(EP) 07/2021 Continuing professional education policy requirements for registered tax agents and BAS agents from 1 July 2022.

[5]For further information regarding a Board approved course in Australian taxation law for tax agents, refer to the TPB’s proposed guideline TPB(PG) 03/2010 Course in Australian taxation law approved by the Board.

[6]For further information regarding the TPB’s approach to approved course providers for the purpose of Board approved courses, which are referred to in the Tax Agent Services Regulations 2022 (TASR), refer to TPB(I) 07/2011 Approval process for course providers

[7]See Explanatory paper TPB(EP) 02/2010 Fit and proper person

[8]See Explanatory paper TPB(EP) 01/2010 Code of Professional Conduct

[9]See section 30-35 of the Tax Agent Services Act 2009.

[10] See Australian Qualifications Framework 2011, available at www.aqf.edu.au

[11] For further information regarding the TPB’s CPE policy for registered tax agents and BAS agents, refer to TPB(EP) 07/2021 Continuing professional education policy requirements for registered tax agents and BAS agents from 1 July 2022.